Over the past year, small bags of legal cannabis have doubled in price in California—hitting a record $100 per eighth-ounce in San Francisco this year. This has generated a spate of teeth gnashing among local consumers, and no small amount of gloating from outsiders.

But the doom and gloom is only half the story in California.

That old price point of $60 per eighth-ounce has evolved into a price spectrum that now runs from about $15 per eighth-ounce all the way up that scary $100 bag.

One prime example of the savings to be had is the budding delivery service Flower Co., which uses a business model that’s uncommon in the cannabis world. Dubbed ‘the Costco of cannabis,’ Flower Co. sells direct to members who pay an annual fee of $79 to get access to name brand cannabis that’s about 30%-50% cheaper than going retail prices.

Tony Diepenbrock, co-founder, Flower Co.

The company currently has about 600 members in the Bay Area. They launched March 6 in Los Angeles with an influencer campaign aimed at reaching Grammy nominees like Drake and Childish Gambino. Famed startup accelerator Y Combinator (Airbnb, Dropbox) invested March 19.

Flower Co.’s biggest seller is a $25 half-ounce of “pre-ground” Blue Dream. That’s more than half off current prices.

This wholesale cannabis club isn’t perfect, or right for everybody, but company co-founder Tony Diepenbrock says, “Flower Co. offers a great alternative to people who can’t tolerate the price increases of California legalization.”

Flower Co. Pros and Cons

We’ve ordered three times from the startup, and it’s clear who the service is right for.

It’s great for:

- fixed-income edibles bakers who can turn $50 ounces of ground-up cannabis flower (aka “shake”) into copious amounts of potent canna-butter

- daily smokers who can afford to buy top-shelf in bulk

- pleasure-delayers who don’t mind waiting 72 hours for their order to be delivered

- folks who can stomach California’s 25% taxes plus a delivery fee of $10

It’s not great for:

- small purchases

- same-day or next-day needs

- people who like to account-share like Netflix—Flower Co. requires members to sign for deliveries

- dabblers who don’t know what they want to buy

- low-income folks who can’t afford the $79 membership fee to get started

- and people with shifting schedules— there’s a $10 missed delivery fee if you’re not at home during your delivery window, and it’s against the law to leave the package at your door.

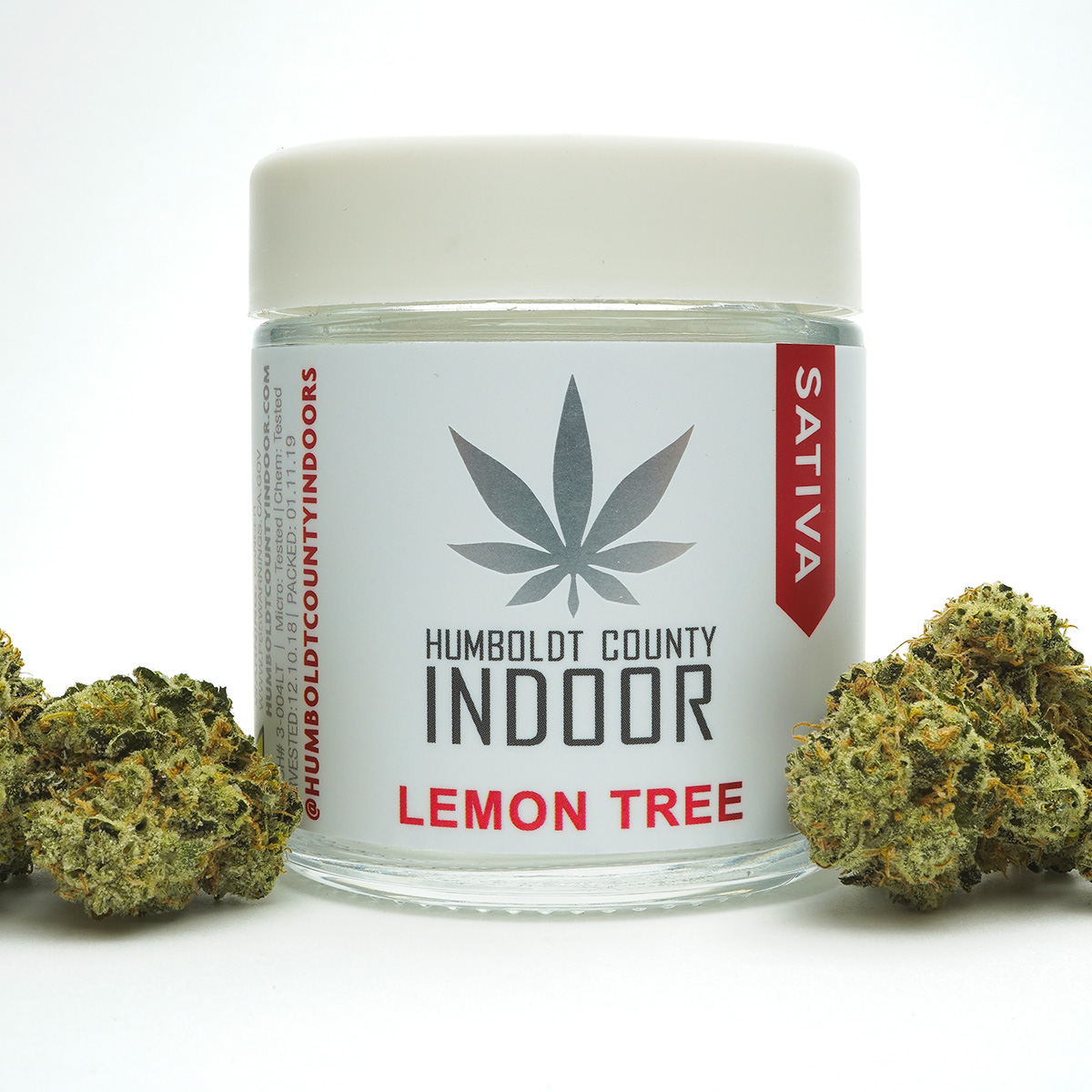

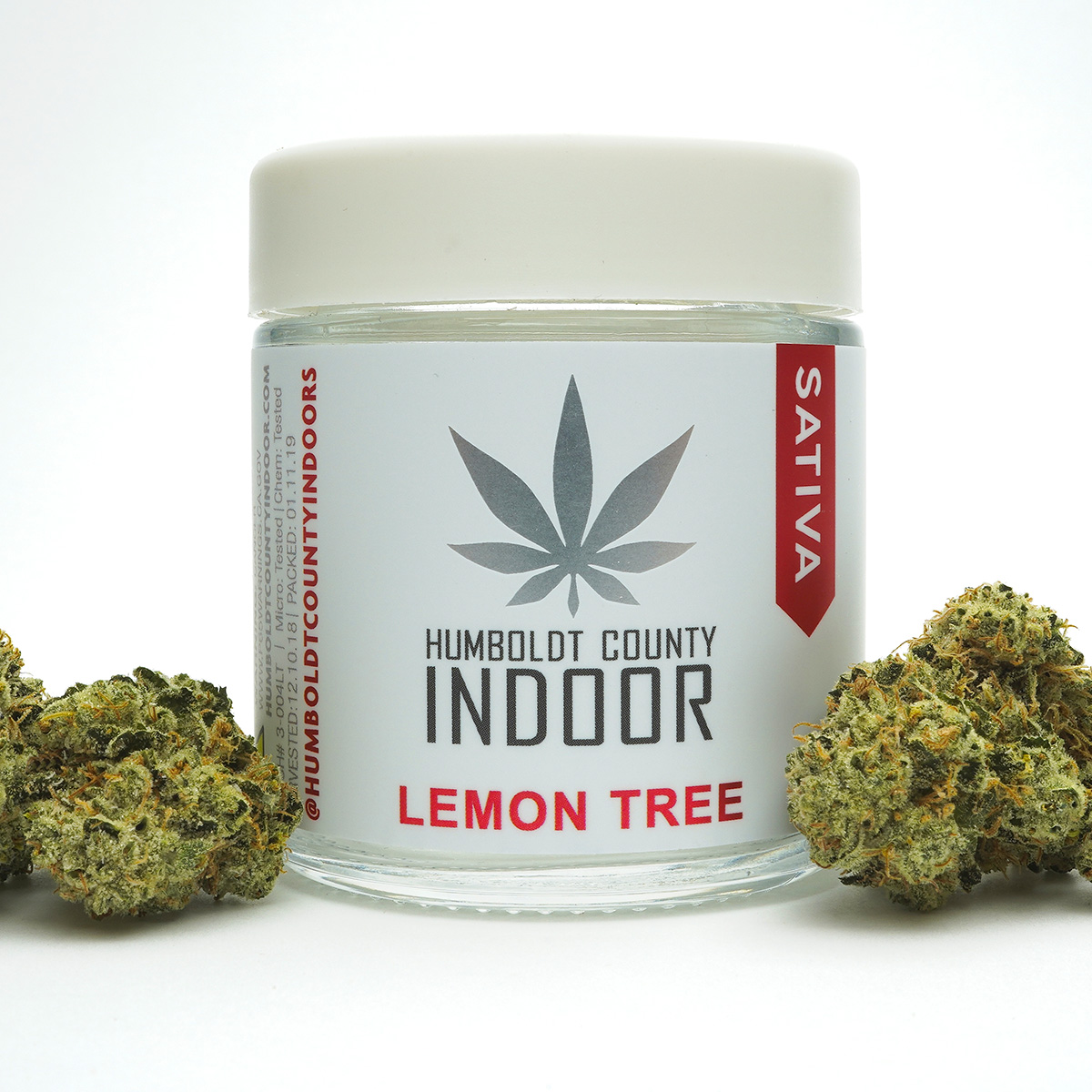

Flower Co. supplies of indoor-grown cannabis includes designer flavors like Lemon Tree, Cake Batter, Grape Sorbet, Mimosa, and Grape Sorbet. (Courtesy Flower Co.)

Flower Co. supplies of indoor-grown cannabis includes designer flavors like Lemon Tree, Cake Batter, Grape Sorbet, Mimosa, and Grape Sorbet. (Courtesy Flower Co.)

California’s Pricing Problems

But so far, Flower Co. is an island of stability in a post-legalization maelstrom.

California voted to legalize adult-use cannabis in November 2016, and commercial sales began Jan. 1, 2018. From the beginning, shoppers bemoaned the lack of local stores (there’s about 600 for a state of 38 million people), and the high taxes.

Taxes can run upwards of 40% when you count:

- the state excise tax (15%)

- state sales tax (8.75%)

- local sales and excise taxes (as high as 20%)

Add it all together, and we’re witnessing shocking post-legalization prices of sometimes $600 per ounce, and $100 per eighth for top-shelf designer bud.

“The taxes have just complicated a lot of people’s lives,” said Flower Co. CEO Ted Lichtenberger. “The size of their wallet hasn’t changed, but the tax burden has.”

About 80% of potential legal customers are staying in the illicit market, surveys have shown. Their number one reason is cost.

Forbidden Fruit. (Courtesy Flower Co.)

Forbidden Fruit. (Courtesy Flower Co.)

Borrowing Solutions From Costco

Diepenbrock and Lichtenberger are both three-year veterans of the medical cannabis industry’s transition to adult-use. They conceived of the business in a Pt. Reyes, CA, apartment in 2018. They wanted to start a cannabis delivery service, but they struggled with cash flow. Cannabis businesses can’t get small business loans from banks. There are enormous start-up costs, and you have to pay for inventory.

Charging an annual fee solves these problems and more—just ask Costco, the sixth most valuable retail brand in the world, with more than 80 million members, 91% of which renew each year. Costco uses $60 annual membership fees to run a no-frills, high-volume, low-margin, bulk-packaged retail business offering deep discounts. (We did the math: Costco’s customers hand the company $4.4 billion in membership fees every year, even before purchasing a single item.)

“I grew up going to Costco,” said Diepenbrock. “I just really love what they’ve done.”

Both men are nuts for lean startups. Beginning in June 2018, Diepenbrock drove the company’s first $100,000 in revenue off of free Google Forms and rabid word of mouth.

Compared to random shoppers, annual members are more loyal, buy more per purchase, and enable the company to better estimate demand; and thus get better prices from suppliers.

The company’s founders had been buying medical cannabis in California’s Humboldt County since 2016, and their supply chain is only getting stronger, Diepenbrock said.

“These are everyday prices,” he added. “This isn’t something where we’re relying on having a homie hookup on a pound of flower, or discounted deals from our brands. We’re just structuring a model that is a higher-volume, more reliable model, which makes supply chain partners happy taking a lower margin.”

(Courtesy Flower Co.)

(Courtesy Flower Co.)

Growing Flower Co. in 2019

The wholesale cannabis club is now up to seven full-time employees. It contracts out the last-mile delivery to licensed cannabis courier companies, which are legal statewide under final regulations from the Bureau of Cannabis Control.

Members re-order on average of every three or four weeks, and customers have a high rate of repeat orders.

“Once they get locked in, they don’t want to buy from anyone else — they’re basically burning their money when they do that,” said Diepenbrock.

Members-only events are popping up in California. (Courtesy Flower Co.)

Members-only events are popping up in California. (Courtesy Flower Co.)

Real-Life Savings—Leafly’s Flower Co. Order History

Order #1:

$192 out the door for seven top-shelf eighths of an ounce, plus one gram of top-shelf extract, with tax and fees.

Estimated savings: ~$190

Order #2

$128 out the door for three eighths, plus one gram of top shelf extract, including taxes and fees.

Estimated savings: ~$90

Order #3

$194 for one ounce of top-shelf buds (Forbidden Fruit), including taxes and fees.

Estimated savings: ~$210