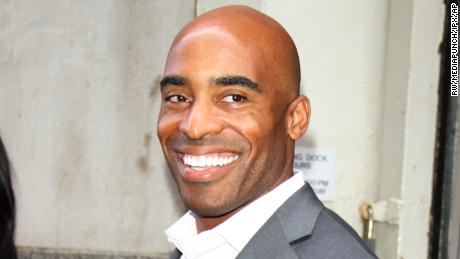

He worked for NBC’s “Today” as a news correspondent and now co-hosts a show on CBS Sports Radio. He’s the co-founder of sports marketing firm Thuzio and he is also currently appearing in Broadway’s Kinky Boots for a brief stint.

Now Barber is hoping to cash in on the growth of the marijuana business in the United States. Barber late last year co-founded Grove Group Management, an investment firm that plans to focus on cannabis start-ups.

Although recreational and medical marijuana have been legalized in many states, the sale and possession of pot remains illegal under federal law. For that reason, Grove Group Management’s official headquarters are in Vancouver. Canada legalized marijuana last October.

So what attracted Barber to cannabis? He said in an interview with CNN Business that increasing evidence of how medical marijuana can help people coping with severe pain will help reduce the stigma around it.

He knows that firsthand from his playing days in the NFL. The league is coping with a growing number of current and retired players dealing with traumatic head injuries.

“The more quickly we can get cannabis legalized federally, the better off athletes will be,” he said, adding that he thinks it’s a “matter of inevitability” before that happens.

That’s why he believes now is a good time to be investing in marijuana. And he specifically wants to help fund smaller, private companies — particularly those led by minorities.

“We can help add jobs. It’s good for small businesses, and that can provide an economic uplift,” Barber said.

Barber said it was too soon to announce the names of any firms that Grove Group Management is looking to invest in right now. But the company is “in the midst of deals right now” and hopes to disclose some of them this quarter.

Grove Group Management is not going to limit itself to just marijuana either. Barber said the CBD market looks attractive following the legalization of industrial hemp in the Farm Bill. CBD is a non-psychoactive component of marijuana.

“CBD is one reason why major companies are more comfortable with getting into the cannabis space. They are starting to think this is very serious,” Barber said.

Beer and wine giant Constellation Brands (STZ), which owns Corona, has made a $4 billion investment in Canadian cannabis company Canopy Growth (CGC). Canopy’s stock is up more than 75% this year And Marlboro maker Altria (MO) recently bought a 45% stake in Canada’s Cronos. Shares of Cronos (CRON) have shot up 55% already in 2019.

Wall Street has noticed too. Several analysts at larger brokerage firms have started to follow some of the cannabis companies.

Piper Jaffray, which just launched coverage on the sector a few weeks ago, boosted its price target on Canopy Friday. That helped spark another rally for Canopy and its rivals.

But Barber said Grove Group Management was not looking to invest in the larger publicly traded marijuana stocks.

“Cannabis stocks look a little overvalued right now,” Barber said. “It’s easier to be on the private side of this.”

Views: 428