July 23, 2019

Earlier today, the Senate Banking Committee held a hearing on the SAFE Banking Act, which would allow financial institutions to engage in activities with state-legal cannabis businesses.

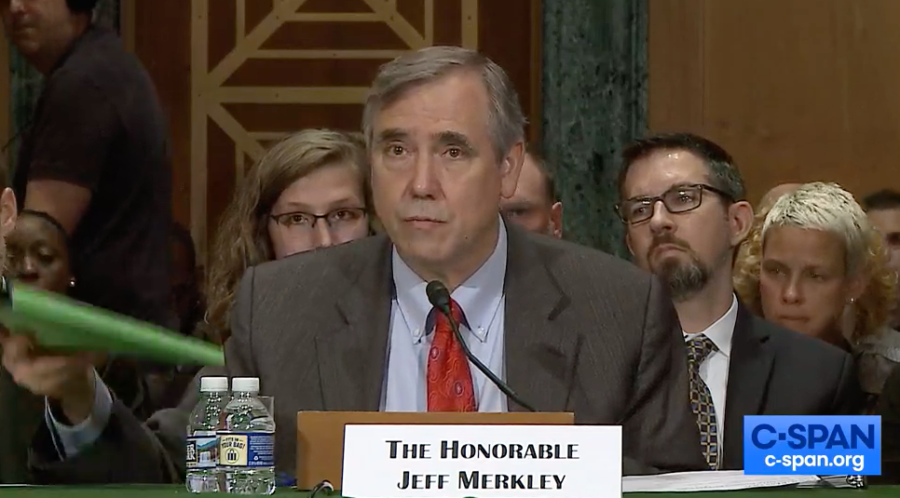

The hearing was entitled, “Challenges for Cannabis and Banking: Outside Perspectives.” Witnesses included Senators Cory Gardner (CO) and Jeff Merkley (OR) as well as the Chief Risk Officer of Maps Credit Union Rachel Pross, President and CEO of Citywide Banks Joanne Sherwood (representing the American Bankers Association), marijuana prohibitionist Garth Van Meter, and John Lord, the owner of a cannabis company.

“Forcing businesses to operate in cash is an invitation to crime, money laundering, and robbery,” said U.S. Senator Jeff Merkley, the lead sponsor of the SAFE Banking Act. “Whether you’re for or against legal cannabis, we all agree that we want our communities to be safe from fraud and crime. That’s why this legislation has significant bipartisan support in both houses of Congress. I’m pleased to see the momentum for this legislation continue to grow, and I’m going to keep fighting to get this legislation over the finish line in this Congress.”

Testifying before the Committee, Senator Merkely thanked NORML for its work and assistance in his office compiling a list of over 100 personal stories that he submitted about how the banking prohibition has impacted them.

Commenting on the hearing, NORML Political Director Justin Strekal said, “We duly recognize that better access to banking is necessary in order for the legal marijuana market to become more transparent and more convenient for customers.”

“No industry can operate safely, transparently, or effectively without access to banks or other financial institutions and it is self-evident that this industry, and the consumers that are served by it, will remain severely hindered without better access to credit, financing, banking, and payment processing,” Strekal continued. “Ultimately, Congress must amend federal policy so that the growing number of state-compliant businesses, and the millions of Americans who patronize them, are no longer subject to policies that needlessly place them in harm’s way. Cannabis businesses ought to be held to the same standards as any other commercial enterprises.”