All across North America, the cannabis industry has been growing at an incredible rate, becoming a $10.4 billion industry in 2018 and on track to surpass $16 billion by the end of 2019. Despite those compelling numbers, many cannabis companies still struggle to access banking services, forcing many to conduct business using cash transactions.

The U.S. cannabis industry’s all-cash status means there’s a risk that some might stumble into the crosshairs of the Internal Revenue Service (IRS). But the IRS also has been sticking another thorn into the side of legal dispensaries and retailers.

A brief, five-page document called Form 8300 has caused a significant amount of financial strife for a handful of cannabis-related businesses. Form 8300 (available as an interactive PDF) must be meticulously filled out every time a business receives more than $10,000 in cash from a single buyer over a single transaction or two or more related transactions in any running 12-month period.

“Form 8300 is the ‘Report of Cash Payments Over $10,000 Received in a Trade or Business,’ which is filed with the Internal Revenue Service and the Financial Crimes Enforcement Network (FinCEN),” Stacey Udell, Director of Valuation and Litigation Services for HBK CPAs and Consultants in Cherry Hill, New Jersey, wrote in an email interview with Weedmaps News. “It is important for cannabis businesses because of the banking restrictions on the industry, which result in significant cash transactions.”

Initially put into place by the IRS to combat money laundering, the enforcement measure particularly affects cannabis companies because most rely heavily, and often exclusively, on cash transactions. The government agency started using the form to start auditing a few Colorado-based cannabis companies in 2016, probing to see if they properly filled out the form and filed it.

“Because there’s a law on the books that requires these transactions to be reported, by default they apply to the cannabis industry. Without access to banking, it’s a form that cannabis companies need to file in order to maintain compliance,” said Mario Ceretto, a certified public accountant in San Diego.

If a cannabis company fails to disclose such a transaction, the IRS can impose a penalty of $25,000 or the actual amount of the transaction up to $100,000, whichever fine is the greater amount.

If a cannabis company fails to disclose such a transaction, the IRS can impose a penalty of $25,000 or the actual amount of the transaction up to $100,000, whichever fine is the greater amount. Click To Tweet

Most publicly debated tax-related concerns in the cannabis industry have revolved around a federal statute, 26 U.S. Code Section 280E, that states that businesses engaged in trafficking of a Schedule I or II substance in the Federal Controlled Substances Act are prohibited from taking tax deductions or credits.

Cannabis companies might not know that they are required to fill out Form 8300, and there are some business types in the industry that tend to be more vulnerable than others. For instance, cannabis growers that sell a hefty amount of their products to a single dispensary or production client over a yearlong period are more prone to dealing with large cash transactions. The same goes for other product suppliers, even those that provide cannabis dispensaries with goods and services such as security, grow equipment, and point-of-sale (POS) systems.

Udell provided an example scenario that would require the form.

“A distributor sells some cannabis for $6,500 to a dispensary. As part of the deal, the dispensary agrees to buy other cannabis-related retail goods for $4,000,” Udell explained. “The dispensary pays with travelers’ checks for both the cannabis and the accessories. The seller must complete and file Form 8300 because the total amount of the two transactions is more than $10,000.”

It’s important to distinguish exactly who is responsible for filing Form 8300. Remember that the recipient of the cash transaction is required to fill out this form, not the provider. So if a dispensary is paying more than $10,000 in cash to a security guard company to protect the store property, the burden of reporting that transaction on Form 8300 falls on the security company, which would be the recipient of the transaction.

How to Avoid Issues with Form 8300

For cannabis businesses that have engaged in cash transactions that exceed the $10,000 limit, the most important step is to correctly fill out and file Form 8300. The IRS recently started allowing businesses or individuals to file Form 8300 electronically via the Bank Secrecy Act (BSA) E-Filing System.

Cannabis companies can take other precautions to avoid triggering an IRS audit.

“Being proactive with the form, filing it correctly, timely and consistently will be the best safeguard for preventing any scrutiny in the end,” Ceretto said. “The penalties for not doing it certainly outweigh the risks of filing them.”

When a single cash payment is more than $10,000, the form should be filed within 15 days of receiving the cash transaction. If the first payment does not exceed $10,000, but additional payments are made within a 12-month period, the form should be filed within 15 days from when the total cash amount exceeds $10,000. Required information includes information about the business or customer who initiated the transaction and the total reportable cash that was received during any running 12-month period. It’s important for businesses to comply with filing requirements, as well. The IRS can penalize a company for filing Form 8300 late and even inflict a minimum penalty of $25,000 for “intentional or willful disregard of the cash reporting requirements.”

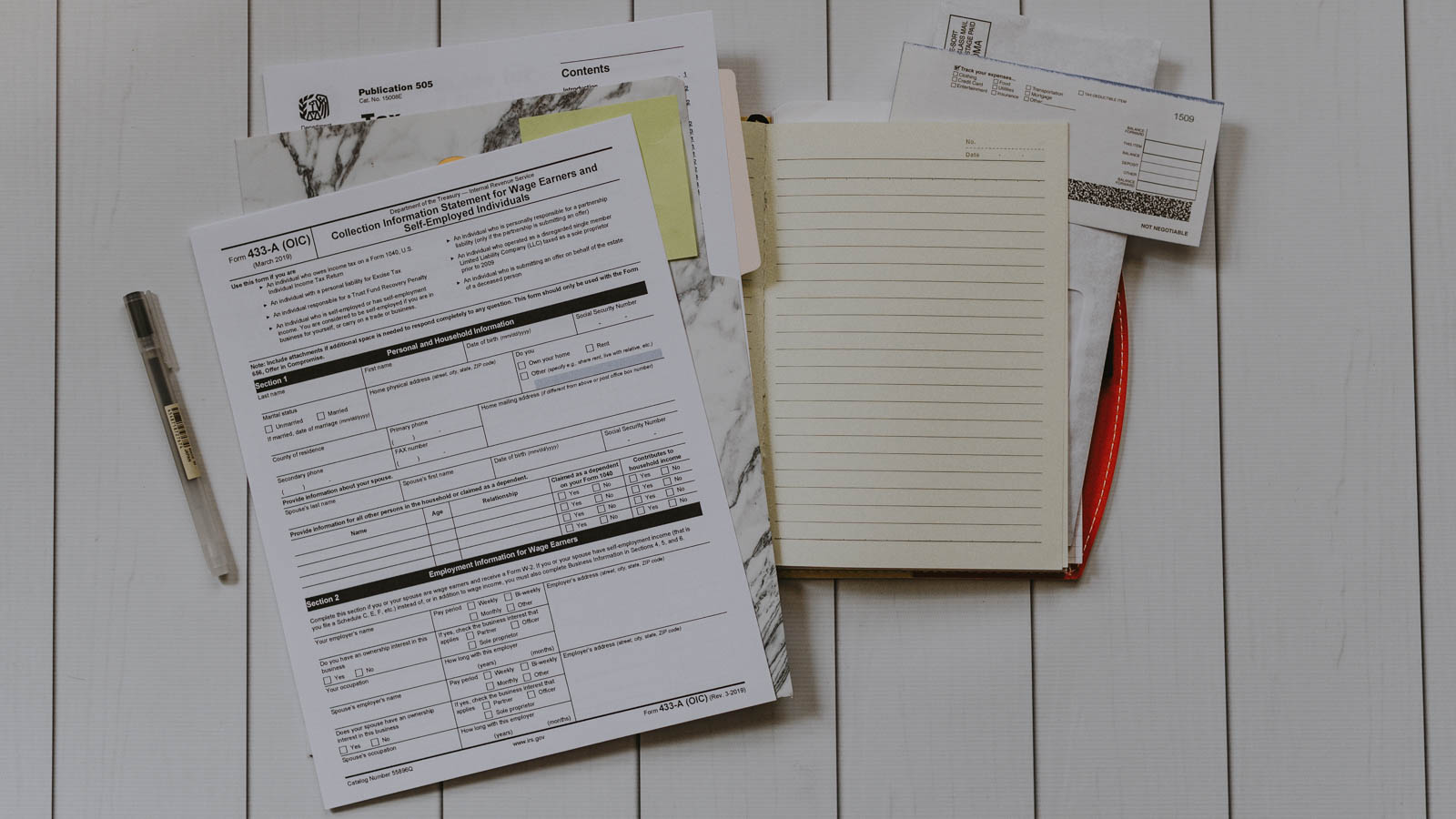

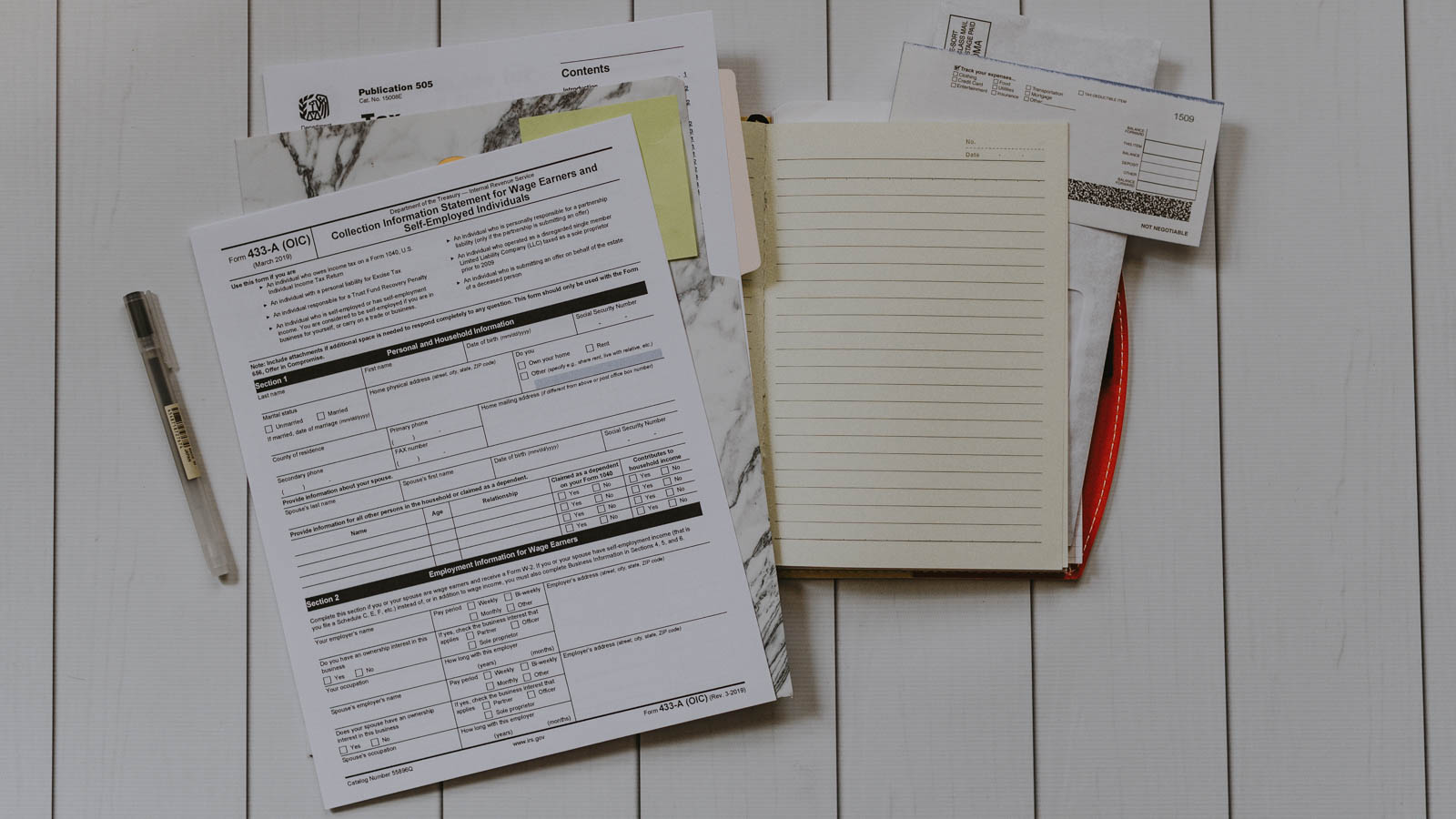

Doing business in cash requires special documentation for the Internal Revenue Service. (Photo by Vladimir Solomyani on Unsplash)

Even after Form 8300 has been filed, the IRS requires companies to hold onto a copy of the form for five years. Therefore, any cannabis company that is required to fill out this document should store a printed copy in a safe location, which doesn’t always sit well with some cannabis companies or individuals, according to Ceretto.

“A lot of people don’t want a document with sensitive information like their address and Social Security number floating around,” Certetto said. “Another issue is the fact that they’re filing it and putting themselves on the radar. Granted, yeah, that might potentially trigger an audit, but it’s highly unlikely.”

Considering the hefty penalties that can be enforced for not filing this form, it’s safe to assume that the benefits outweigh the potential downsides.

“There just needs to be more education around this topic,” Ceretto said. “I think it’s very important to make sure that the industry is in sync with each other and on the same page with this issue.”

Featured Image: In addition to the usual tax documents, Form 8300 must be meticulously filled out every time a business receives more than $10,000 in cash from a single buyer over a single transaction or two or more related transactions in any running 12-month period. ( Photo by Kelly Sikkema on Unsplash)